So we are in agreeance here?

You need a balance in all walks of life, once it goes to far to one side problems start to arise.

I know from some stories my father tells me how particularly in the 70's and 80's the Unions could call a strike from the drop of a hat.

Now things have gone too far the other way where employers have the upper hand in many cases.

The neo-Conservative movement which started with the Thatcher government in the late 70's has spread to many countries in the western world, destroying the power of Unions, privatising and selling off everything state owned. If this is the pinnacle of Capitalism, then it certainly is not good.

oh look man, id be shocked if a great percentage of our population aren't in agreement that union representation is essential for a significant portion of the workforce.

but

the downfall of the argument is some of these unions don't want to be governed under the same rules as corporations despite having access to, and being responsible for massive amounts of money and power. its a dangerous situation when the people in power go unchecked. whether thats a CEO or a union boss its all the same.

also, a huge majority of the union bosses are in the top 1% of income earners in this country. (yes, the top 1%)

but here they are doing a good job at convincing the 'workforce' they are rallying agains the 1%ers despite being front and centre of that group.

id love to see one set of rules for everyone.at the moment there isn't.

Last edited by plague; 20-05-2016 at 10:19 PM.

id actually love to see one freaking tax rate no matter what you earn, be it from business, wage, investments or super.

find the average, tax them all and there can be no grounds for complaint.

having tax rates range from 30%-48% only invites people to try and bend the rules.

and as someone who bends them as far as I can its quite sad what you can get away with in this country (legally) with a half decent accountant.

It's not Capitalism it is a Plutocracy.

Capitalism is a system whereby those that own the means of production seek profits and those that work with the means of production resist wage cuts.

When Neo-Liberalism took away the power of Unions to resist wage cuts the system was broken.

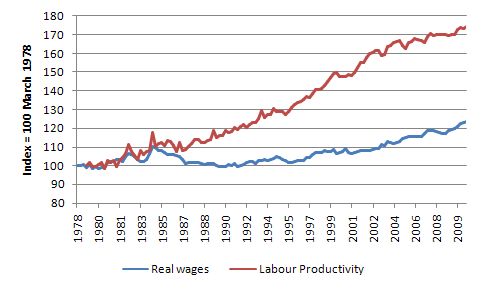

If you look at time series data for wages and productivity you can see that up until the early 1970's wages increase pretty much perfectly tracked productivity gains.

This was good because Capitalists could make more by increasing output, workers made incremental gains in income so they could purchase the output - and overall, both parties had an incentive to work.

From the 1970's gains in productivity have not been matched by increases in wages. Therefore, those working with the means of production have not had incomes sufficient enough to purchase the goods and services produced. The Capitalists, even though they have more money, they also have a much lower propensity to spend and therefore spending is at a lower level than it would have been if those working with the means of production gained their fair share.

By the late 1980's the Neo-Liberals came up with a solution called Financial Engineering which saw credit at levels we had never before seen available to pretty much anyone capable of signing on the dotted line.

Now the Capitalists could have their cake and eat it to and those taking up the credit on offer could pretend they could actually afford the lifestyle they had now become accustomed to.

The big winners in all this - BANKS. Even the capitalists in the traditional sense of the word are an endangered species because once households realise they need to reduce their credit holdings [and this has been happening for a while now consumption spending on anything but essentials has plummeted.

Last edited by The Dunster; 21-05-2016 at 10:17 AM.

You need to use the labour Productivity index and wages index data. To complile this data you also need to understand the difference between a stock and a flow, and the difference between a real and a nominal value.

Did your graph come from the ABS or did you create it using data you found on the ABS website ?

This is what you need:

http://www.rba.gov.au/statistics/tables/xls/h04hist.xls

http://www.abs.gov.au/AUSSTATS/abs@....res1Dec%202014

Below is this data put together by Billy Mitchell at COffee.

Below is the international story

Last edited by The Dunster; 23-05-2016 at 12:09 PM.

It's not different at all.

Use these: http://www.rba.gov.au/statistics/tables/xls/h04hist.xls

http://www.abs.gov.au/AUSSTATS/abs@....res1Dec%202014

The gap explains changes in income distribution away from labour to Capital. Pretty ****ing simple even for someone like yourself.

Solved. Next!!!

Last edited by The Dunster; 23-05-2016 at 12:34 PM.

http://bilbo.economicoutlook.net/blog/?p=33031To understand the significance of the gap between real wages growth and labour productivity growth the following points should be noted:

Employment is measured in persons (averaged over the period).

Labour productivity is the units of output per person employment per period (in this case per hour).

The wage and price level are in nominal units; the real wage is the wage level divided by the price level and tells us the real purchasing power of that nominal wage level.

The total economy-wide wage bill is employment times the wage level and is the total labour costs in production for each period.

Real GDP is thus employment times labour productivity and represents a flow of actual output per period; Nominal GDP is Real GDP at market value – that is, multiplied by the price level. So real GDP can grow while nominal GDP can fall if the price level is deflating and productivity growth and/or employment growth is positive.

The wage share in national income (GDP) is the share of total wages in nominal GDP and is thus a guide to the distribution of national income between wages and profits.

Unit labour costs are in nominal terms and are calculated as total labour costs divided by nominal GDP. So they tell you what each unit of output is costing in labour outlays.

Real unit labour costs [RULC] are calculated by dividing Unit labour costs by the price level to give a real measure of what each unit of output is costing. RULC is also the ratio of the real wage to labour productivity and is equivalent to the Wage share measure.

From the last point, if real wages growth is above productivity growth then RULC are rising, which is the same thing as saying that national income is being redistributed to wages (workers).

However, if real wages growth is below productivity growth then RULC are falling, which is the same thing as saying that national income is being redistributed away from wages (workers) to profits (capital).

It can get a little more complicated if the share that government claims changes but that is normally stable, which means the dynamics of national income distribution are between wages and profits.

I honestly don't know what more I can do to help you here.

Last edited by The Dunster; 23-05-2016 at 02:56 PM.

It would appear I'm not the only one that is getting it all wrong.

Couscous needs to get down to AUSTRADE Headquarters and sort them out as well it would seem.

Then we go to the ABC who use some very well known Economic mongs for all their information and low and behold we get this:

Lmfao at Chris Richardson and the other usual suspects the ABC use for their information.

To say this graph is misleading is an understatement to say the least.

The ABC is an absolute disgrace when it comes to the economy and finance.

Last edited by The Dunster; 23-05-2016 at 04:51 PM.

http://www.rba.gov.au/statistics/tables/xls/h04hist.xls

The link is correct. Think really hard - there is something you are missing.

Are you looking at hourly real wages and labour productivity per hour ?

Last edited by The Dunster; 23-05-2016 at 08:58 PM.

Nice graph. Not taking the piss here but why didn't you use the index data ? Serious question.

The Real wages index over this period has not increased anywhere near as much as LFP index has.

From the graph I posted above the real wage index and labour productivity indexes have a base year of 1978.

EDIT:I just opened the spreadsheet I linked and note that it doesn't go back to 1978 and is in fact indexed to a base year of 2013/14 rather than 1978 as I had assumed.

My apologies. I'll be burning all degrees and qualifications before sunset.

Last edited by The Dunster; 24-05-2016 at 08:13 AM.